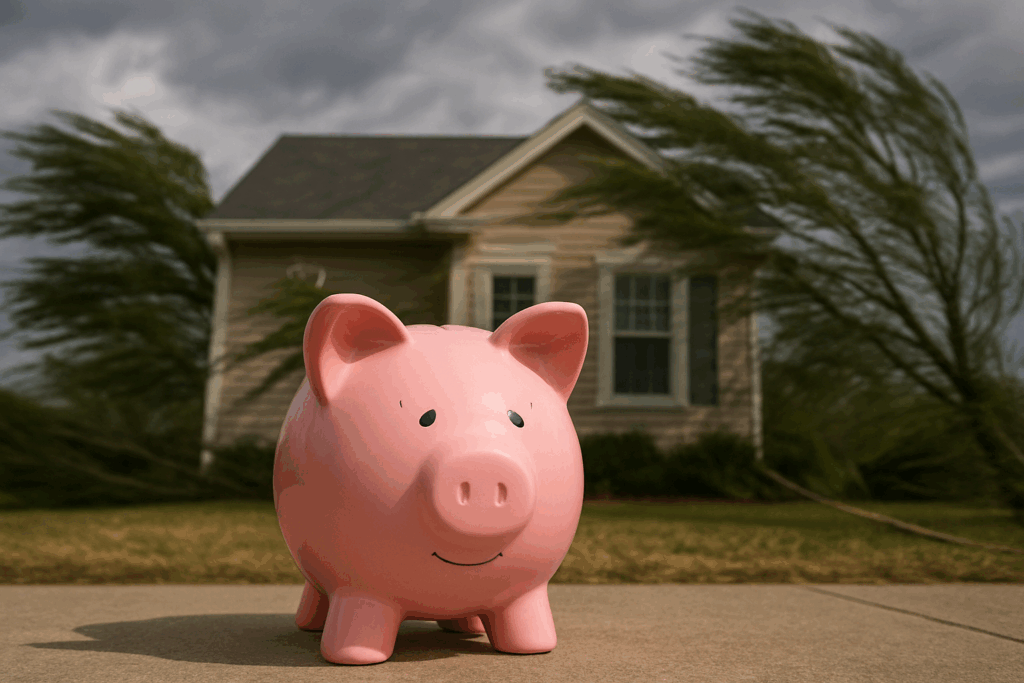

If you’re a Florida homeowner, you’ve probably noticed how much your insurance premiums have climbed in recent years. One of the best-kept secrets to lowering your homeowner’s insurance bill is a wind mitigation inspection. It’s a simple step that can lead to major savings – sometimes hundreds or even thousands of dollars each year.

Depending on your home and your insurance provider, discounts can range from 10% to over 45% off the windstorm portion of your premium. Here are the savings reported by some top providers:

Progressive Insurance

Offers up to 90% in policy credits for homes with strong wind mitigation features.

Source: Progressive

W3 Insurance

Reports homeowners can save up to 88% off the hurricane/wind portion of their premium.

Source: W3 Insurance

Notes discounts of up to 45% on total premiums with certain mitigation upgrades.

Liberty Fin Group

Indicates that homeowners with certain wind mitigation features can save 20% to 40% on their insurance premiums.

Source: Liberty Fin Group

Florida Department of Financial Services

Confirms insurance companies are required to offer discounts for qualified wind mitigation improvements.

Source: MyFloridaCFO

What Features Qualify for Discounts?

Insurance companies typically look for:

- Hip roof shape – where all sides slope downward to the walls

- Roof deck attachments – nail size (i.e. 8d) and close spacing

- Hurricane clips or straps securing the roof-to-wall

- Impact-rated windows, doors, garage doors, skylights (or hurricane shutters)

- Roof covering age and type – meeting Florida Building Code (2001 or later)

- Secondary water resistance (SWR) – secondary water barrier between the roof covering and roof deck

You don’t need to have all of them—but the more features you have, the more you save.

Calculate Your Savings:

Florida Wind Insurance Savings Calculatorhttps://apps.floridadisaster.org/wisc/